We’ll Examine the field’s best car lenders, outlining the rates and providers they supply for straightforward comparison. You’ll also get methods for obtaining the finest car loan prices and learn the way to create sound monetary possibilities about motor vehicle financing.

Co-applicants may very well be permitted — In order to use with An additional man or woman, Oportun may perhaps approve a co-applicant. Making use of which has a co-applicant may well assist you qualify with the loan or get far better terms.

Every single lender advertises its respective payment limits and loan sizes, and finishing a preapproval course of action can present you with an idea of what your curiosity fee and regular monthly payment could be for these kinds of an sum.

Not surprisingly, there’s no this sort of detail as a absolutely sure detail, but knowing your Approval Odds may well enable you to slim down your decisions. By way of example, you might not be accepted because you don’t fulfill the lender’s “ability to pay out normal” once they verify your money and work; or, you have already got the maximum range of accounts with that particular lender.

Streamlined application process: We regarded regardless of whether lenders provided very same-day acceptance conclusions and a quick on-line software system.

So how exactly does LendingTree Receives a commission? LendingTree is compensated by businesses on This great site which payment could effects how and in which delivers surface on this site (including the purchase). LendingTree won't consist of all lenders, price savings merchandise, or loan choices accessible during the Market.

Present-day mortgage rates30 12 months mortgage rates5-calendar year ARM rates3-year ARM ratesFHA mortgage ratesVA home loan ratesBest home loan lenders

The rate table down below compares the lenders with the bottom interest costs for car funding. We’ve damaged down Every service provider’s lowest APR, auto loan conditions, and credit history specifications:

In case you apply on the web, you will need to comply with receive the loan Take note and all other account disclosures delivered with your loan origination within an electronic structure and supply your signature electronically.

However, your power to find the greatest automobile loan costs is depending on some crucial variables, with all your credit score currently being one of the most impactful. While in the table below, you’ll see how significant of the effect your credit score score performs in the car financing fee you’ll get:

Negotiation: If you receive various delivers, you check here could possibly use them to negotiate curiosity rates involving vehicle lenders.

Loan Details: Our researchers comb through the good print to find out about the loan quantities, phrase lengths, and kinds of loans Every company provides.

Together with purchase loans, borrowers might get lease buyout loans, auto refinance loans, and dollars-out refinancing from AUTOPAY. Given that the company performs with numerous car or truck lenders to search out sensible rates, you could count on to receive regularly competitive offers.

Credit rating report: Lenders evaluate your whole credit score report, so two individuals with the exact same credit score could nevertheless obtain different prices.

Jake Lloyd Then & Now!

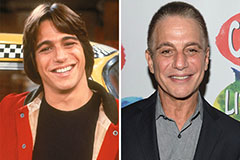

Jake Lloyd Then & Now! Tony Danza Then & Now!

Tony Danza Then & Now! Michael Oliver Then & Now!

Michael Oliver Then & Now! Daryl Hannah Then & Now!

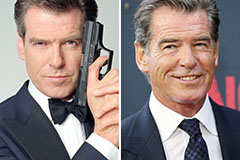

Daryl Hannah Then & Now! Pierce Brosnan Then & Now!

Pierce Brosnan Then & Now!